Bored Yeti Trades

Risk-First Futures Trading

Inspired by Tom Hougaard. Built on discipline, research, and transparency.

I share the real journey of trading futures. The wins, the drawdowns, and the lessons learned along the way. I’ve also built tools to size positions, track ranges, and adapt to volatility.

Trading Tools

Built for Discipline

Most traders fail not because they lack setups, but because they fail to control risk. Volatility punishes the undisciplined. Position size is either too big, or it changes day to day without logic. That inconsistency kills accounts.The tools I built are designed to take discipline out of my head and put it into my process. They calculate size, risk, and levels instantly, so I cannot lie to myself.

Define the range and stop

Instantly size the trade to fit risk

Adapt to volatility and account every single day

Keep execution mechanical so emotions don't interfere

Why Volatility MattersOne thing I’ve learned from Tom Hougaard is that the market doesn’t care about my opinion, my setup, or my confidence. It only reveals itself through volatility. The Opening Range, the Initial Balance, and the additional ranges I track are not random. They define the playing field every single day.When I tie every trade to meaningful ranges, my position size is forced into discipline. Volatility dictates my risk. The tools enforce it without hesitation. I stop adjusting by feel, and I stop lying to myself. I just execute.Consistency begins the moment volatility decides my risk, not me.

How Risk Is Calculated

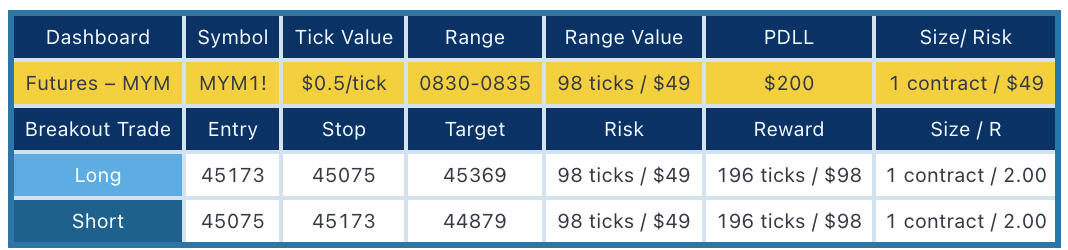

Every trader talks about risk, but few define it with precision. Most size trades by feel until one volatile day wipes them out.The Dashboard, I built for TradingView, forces discipline with three questions:

1. What is my account size and daily loss limit?

2. What percentage of that am I prepared to risk on one trade?

3. How far is my stop, in ticks or points, based on today’s range?Answer honestly, and the math is done. My initial size is no longer negotiable.• Contracts = Dollar risk allowed ÷ Stop distance × Tick value

• The result is the exact size that keeps me inside my limits, no matter how wild the market gets.I don’t adjust it by feel. I don’t second-guess it. I take the number and trade it.

What I’ve Learned

• Volatility defines the stop.

• The stop defines position size.

• The tools enforce it mechanically.

• I measure trades in R, not dollars.

• I’m applying Hougaard’s principles, at my scale.

How I Trade

The Market Gives Ranges. My Job Is to Execute.

I don’t predict. I react. The market gives me ranges. The Opening Range, the Initial Balance, and custom ranges I’ve added to my process. These ranges define volatility in real time. My job is simple: size the trade, respect the stop, and execute without hesitation.

Rules of Engagement

Initial position size is fixed. The tools calculate it before the trade.

Stops are non-negotiable. Every trade is anchored to a clear range.

I measure in R, not dollars. R is my unit of risk. Profit targets in 2R, 3R, or more are for reference. Structure and price action guide the exit.

Scaling in is allowed but max risk never increases. I only add to winners after moving my stop to protect the initial risk.

Execution is mechanical. No hesitation, no adjusting by feel.

What I’ve Learned from Tom Hougaard

My trading journey has been heavily influenced by Tom Hougaard. His focus on discipline, volatility, and the courage to press an edge has shaped the way I approach the markets.I don’t trade his setups exactly as he does, but studying them has taught me how to anchor trades to ranges, size positions to volatility, and execute without hesitation. The tools and process I use today are my own, but the foundation was built on lessons I’ve learned from Tom.👉 Learn more about Tom Hougaard's work at TraderTom.com

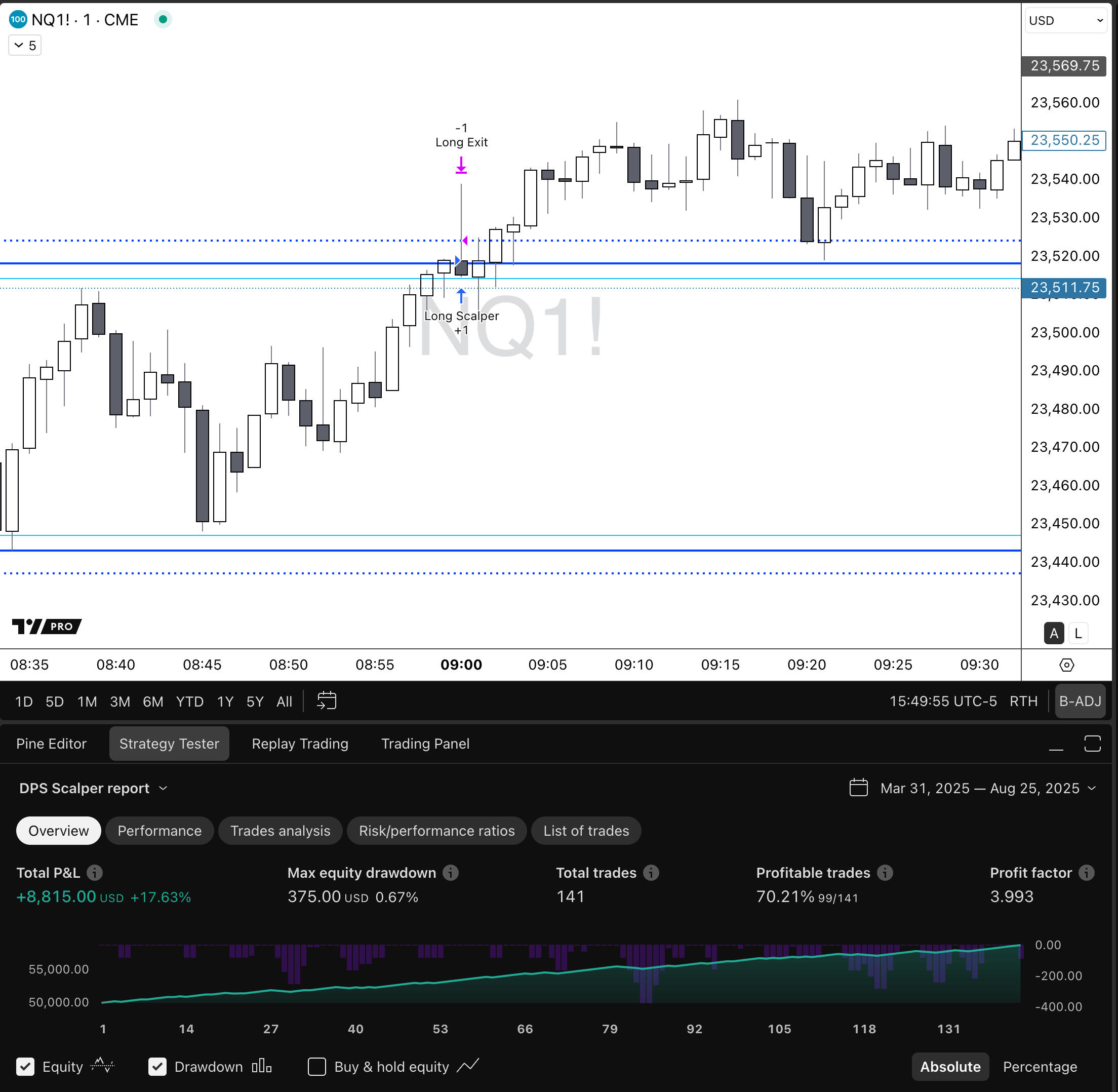

Scalper Tool

Scalping Ranges

This is the most mechanical part of my trading. Every trade has the same stop and the same target fixed in ticks, every day. Nothing changes with market conditions. Position size stays the same too, unless my account grows large enough that I choose to double it. That’s the only adjustment.The method is simple: one long, one short. Same stop, same target, same size. Backtesting shows the historical results, but the real edge comes from keeping the process identical, day after day.

Rules of Engagement for Scalping

Stop-loss: fixed in ticks, never changes.

Take-profit: fixed in ticks, never changes.

Position size: always the same, only doubles with account growth.

One long, one short: same structure every session.

Repetition is the edge: backtesting, forward testing, and daily execution.

tradingview

The Tools I Use Every Day

These tools aren’t required to trade but they’ve improved mine.

I built them to keep my risk mechanical and my process disciplined. They anchor every trade I take, and they’ve helped me avoid mistakes I used to make. That’s why I’m sharing them here. If they can help you too, you’re welcome to use them.

Test Drive

$7 Test Drive

Try the exact tools I trade with for one week.

• Full access to the Dashboard and Scalper

• All features unlocked

• TradingView account required

Try everything. No restrictions. If it doesn’t improve your discipline, walk away.

Secure checkout powered by Whop

Monthly Subscription

$9.99

Keep using the tools I trade with every day.

• Ongoing access to the Dashboard and Scalper

• All features unlocked

• TradingView account required

One oversized trade can cost more than an entire month. These tools keep my risk steady so I can stay in the game.

Secure checkout powered by Whop

Contact

Questions?

DisclaimerThe Bored Yeti Trades and all related materials are provided for educational purposes only and do not constitute investment advice. Futures trading involves significant risk and is not suitable for all investors. You may lose more than your initial investment. Past performance is not indicative of future results. Always trade only with capital you can afford to lose and consult a licensed financial advisor before making trading decisions.